Major U.S. equity markets were positive last week as the second quarter earnings season began. To date, 9% of S&P 500 companies have announced results. So far, almost three-fourths of those companies reporting are seeing an average increase of 6.3% above estimates. While we are just in the beginning of earnings reports, we’ll take all the good news we can get.

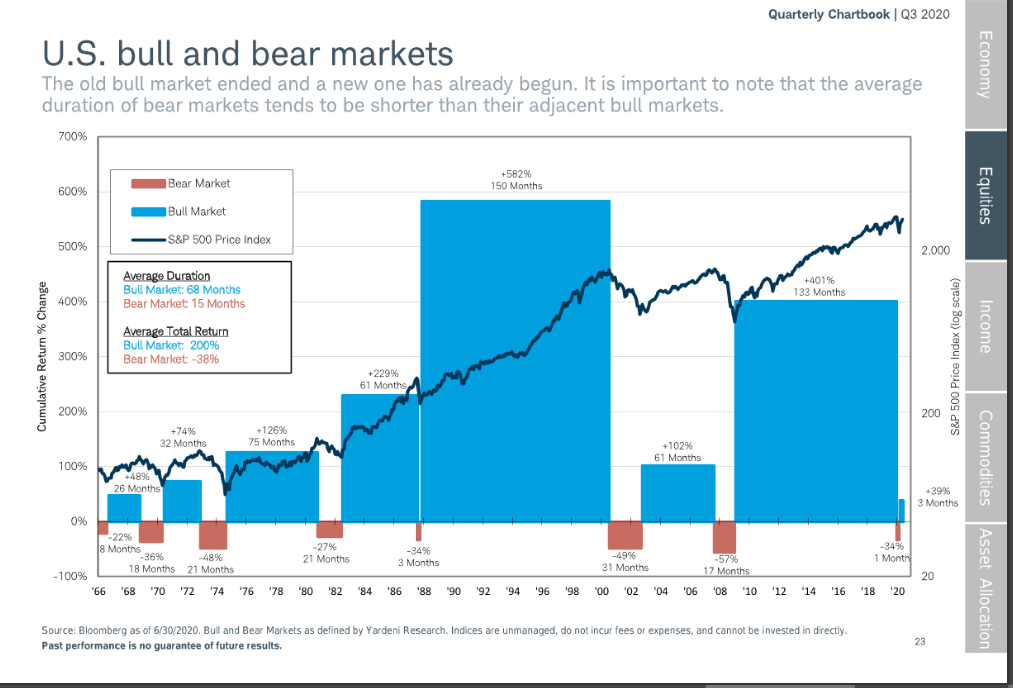

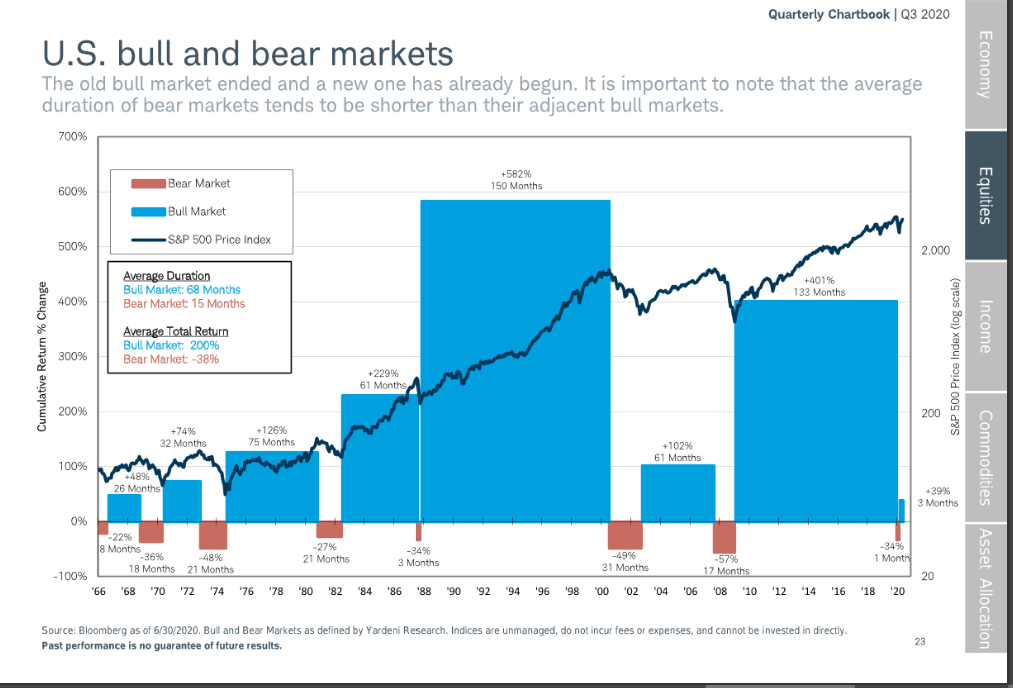

Investors continually find themselves perplexed by the shortness of the most recent bear market. While the market pull back produced a loss of 34% off it’s February high, it lasted only one month. That is one of the shortest bear markets in recent history. The next shortest bear market took place in 1987 where it lasted just three months.

You can see by the chart above, courtesy of Bloomberg, how important it is to be invested during bear markets. While it can be extremely painful during the pullback, you never know how long it’s going to last, or how deep it will go. But look at how long the growth period (blue bar) lasts in comparison.

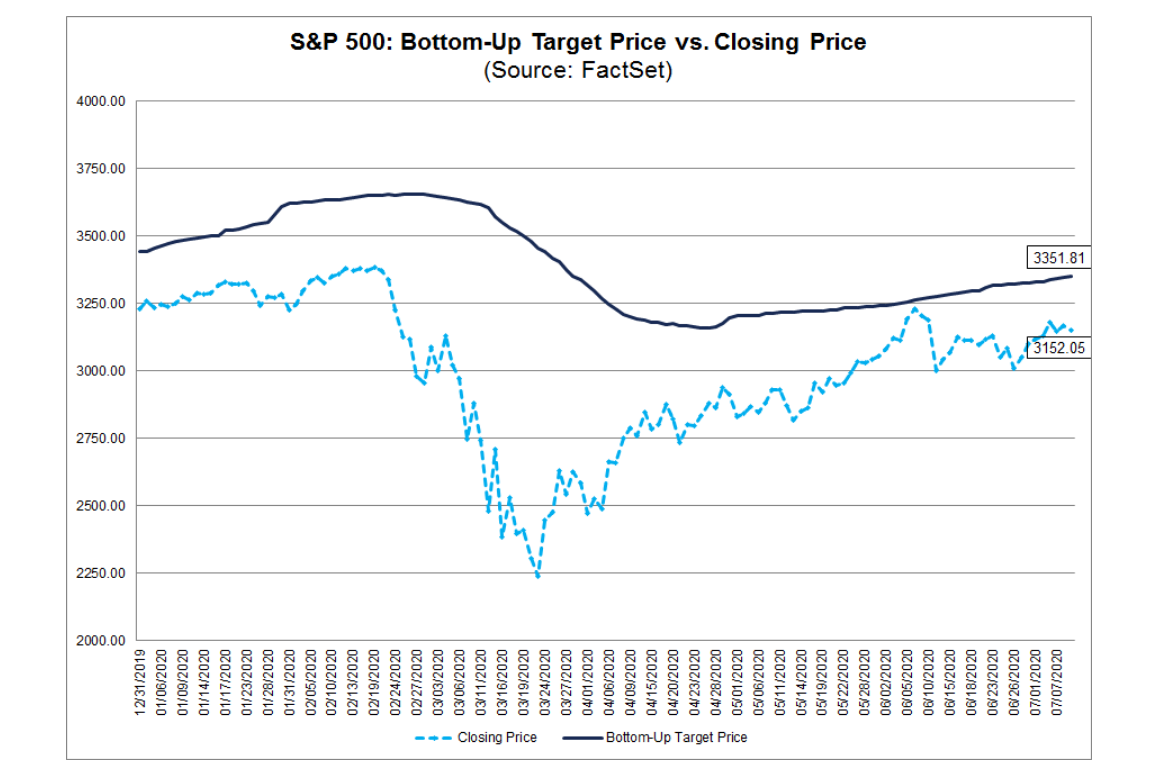

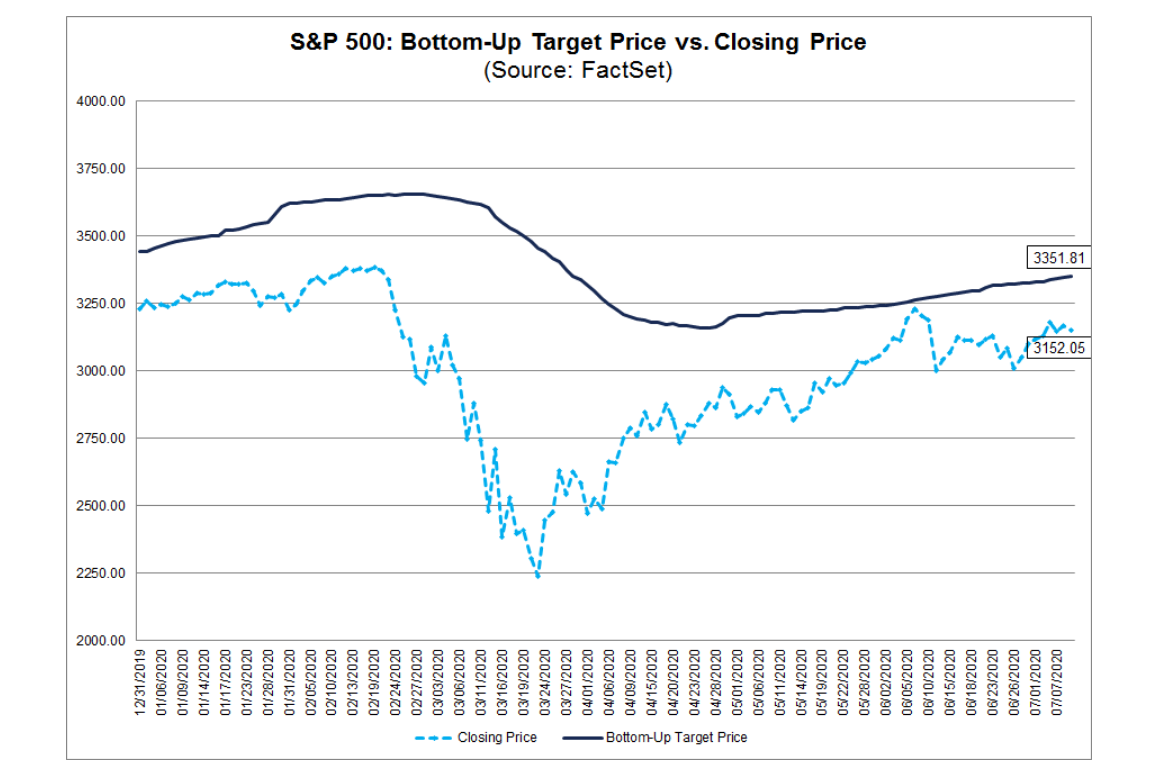

What do analysts expect from the S&P 500 over the next 12 months? According to a survey by FactSet, in the aggregate, analysts expect the S&P 500 to increase by 6.3%. That comes on top of the 20% increase the S&P 500 saw from March 31 to June 30. The dark blue line in the chart below is an average of estimates from analyst. The light blue line is the actual closing price.

It’s important to remember that these estimates from analysts are based on earnings expectations. It doesn’t mean the earnings won’t be bad or worse than they were a year ago. In fact, they most assuredly will be. But analysts and the markets are forward looking. In a way, they’ve already put the bad news behind them and are looking toward the future. We just hope the economy doesn’t grind to a halt as the pandemic seems to be far from over.

The Markets and Economy

- The U.S. budget deficit surpassed $3 trillion in the 12 months ending June 30 as stimulus spending soared and tax revenue plunged. The federal government is on track to post the largest annual deficit as a share of GDP since World War II. The Congressional Budget Office projects the annual deficit could total $3.7 trillion in the fiscal year that ends September 30. However, the gap could widen if the White House and Congress agree this month on another round of emergency spending. Many economists have argued the stimulus is vital to keep households and businesses afloat until the economy begins to recover.

- After United Airlines warned of 36,000 possible layoffs this fall, American Airlines told 25,000 workers that their jobs are at risk after federal aid expires on October 1.

- Surging copper prices are giving analysts something to cheer about. Because copper is widely used in the global manufacturing sector and critical to making everything from smartphones to houses, many market watchers use its price as an economic indicator. Recent advances in the futures market for copper are at their highest since April 2019.

- NBC is the last major network to offer streaming services. Known as Peacock, the late-to-the-game streaming service faces an uphill battle. A lack of marketing and the loss of its centerpiece, the Tokyo Olympics, will hurt the immediate success for NBC Universal.

- A patchwork of differing rules and restrictions are constraining businesses globally as they struggle to deal with countries various regulations for testing and quarantining due to the pandemic. Many countries who have recovered are leery of letting travelers from troubled countries in.

- Retail sales rose a strong 7.5% in June as stores and restaurants began the arduous process of re-opening. The sales were driven by an increase in demand for autos, furniture, clothing and electronics.

- Mortgage rates fell to their lowest levels in almost 50 years of record keeping. The average rate for a 30-year fixed mortgage fell to 2.98% last Thursday according to mortgage-finance giant, Freddie Mac.

- Major U.S. banks are preparing for a wave of loan defaults in the coming months. JPMorgan, Citigroup and Wells Fargo have collectively set aside $28 billion to cover losses. The economic fallout from the pandemic is being felt across several industries.

- Fed governor Lael Brainard warned of a “double-dip” in economic activity, and said that the nation faces a long slow recovery even if those hazards are avoided. “Fiscal support will remain vital,” she said.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, member FINRA/SIPC. Investment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors.